Enter your email to get started

or

As of April 2024 we no longer support signing in through Google. If you previously created your account through Google Sign In, pleaseReset Your Password

InTouch Credit Union Retirement Simplified

InTouch Credit Union and Silvur are partnering together to provide you with all of Silvur’s best-in-class education and tools to validate and improve your retirement plan. We’ll help you navigate through your retirement benefits and expenses so you can make the best decisions for your retirement.

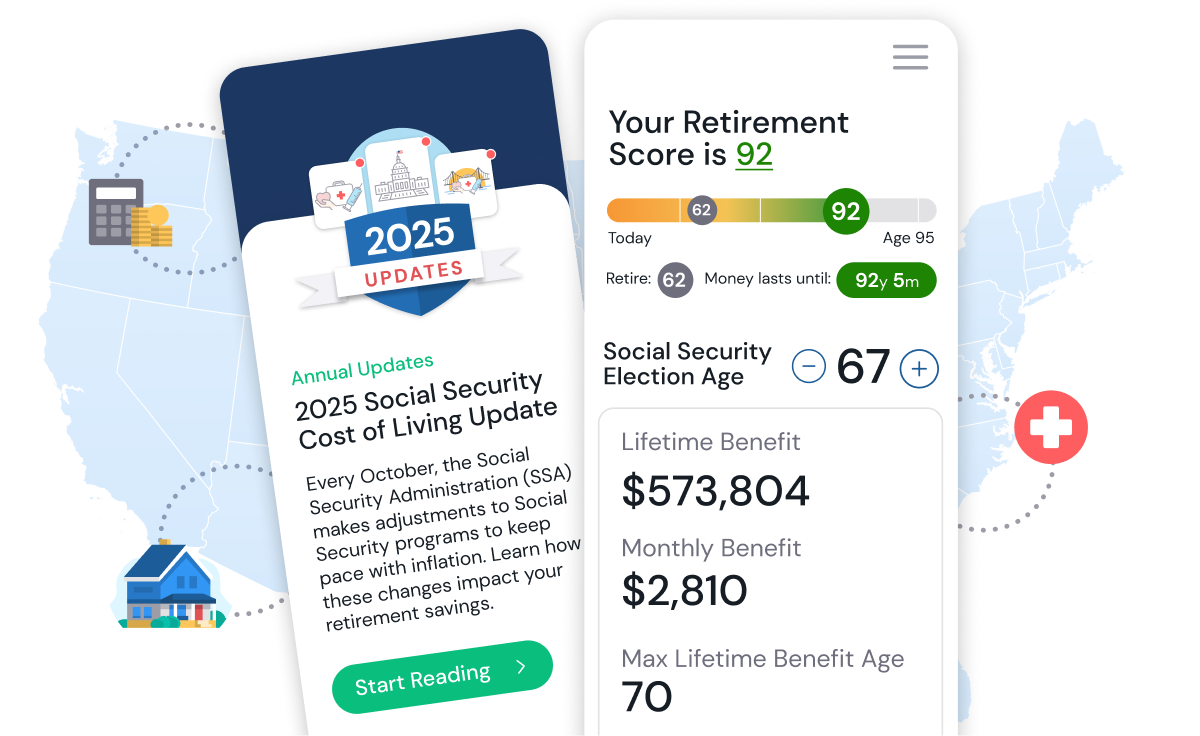

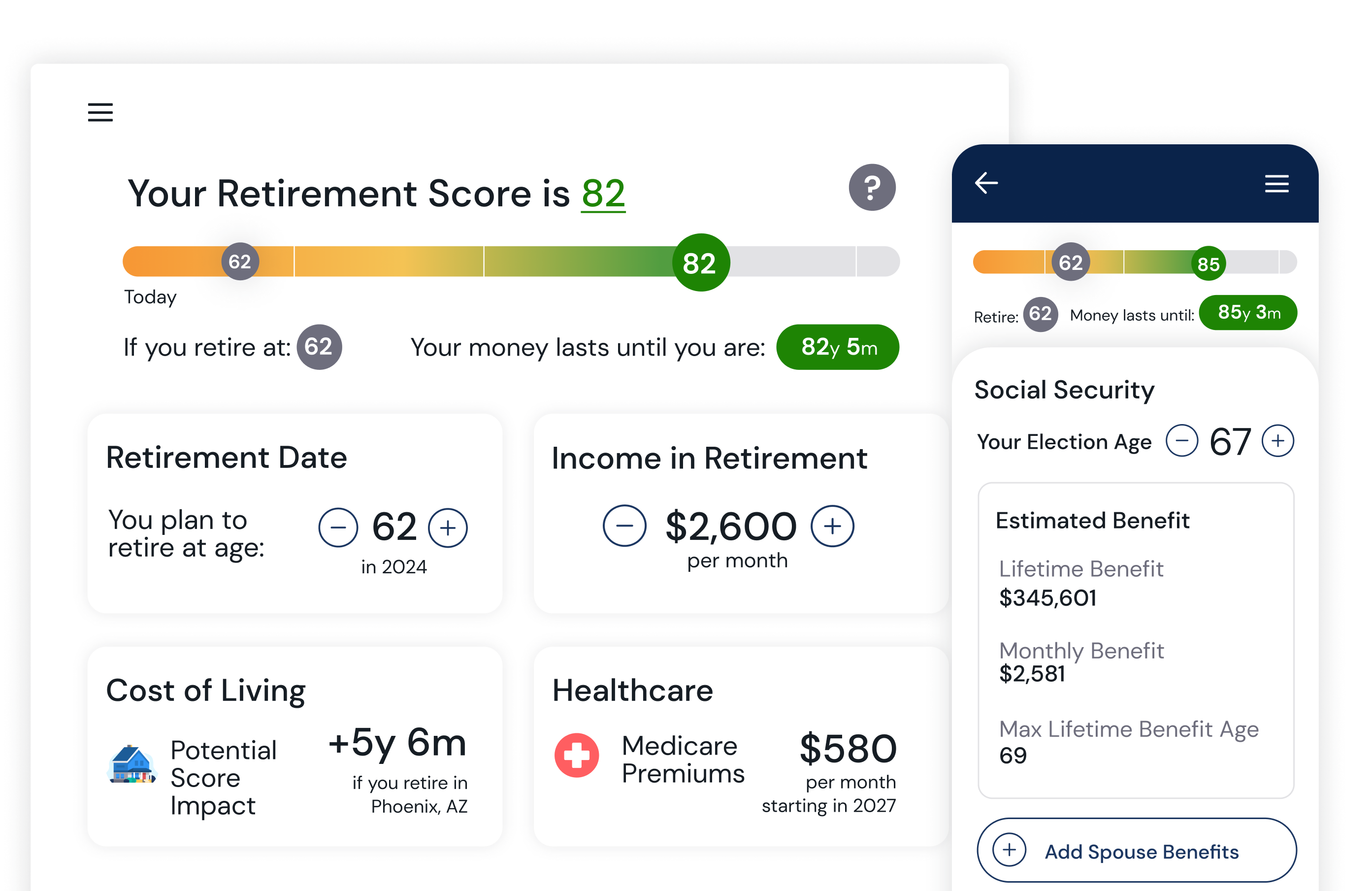

Calculate how long your money will last in retirement—down to the year and month. Our Social Security, Medicare, and cost of living tools let you run different scenarios to see how your choices impact your plans based on where you live, when you retire, and more.

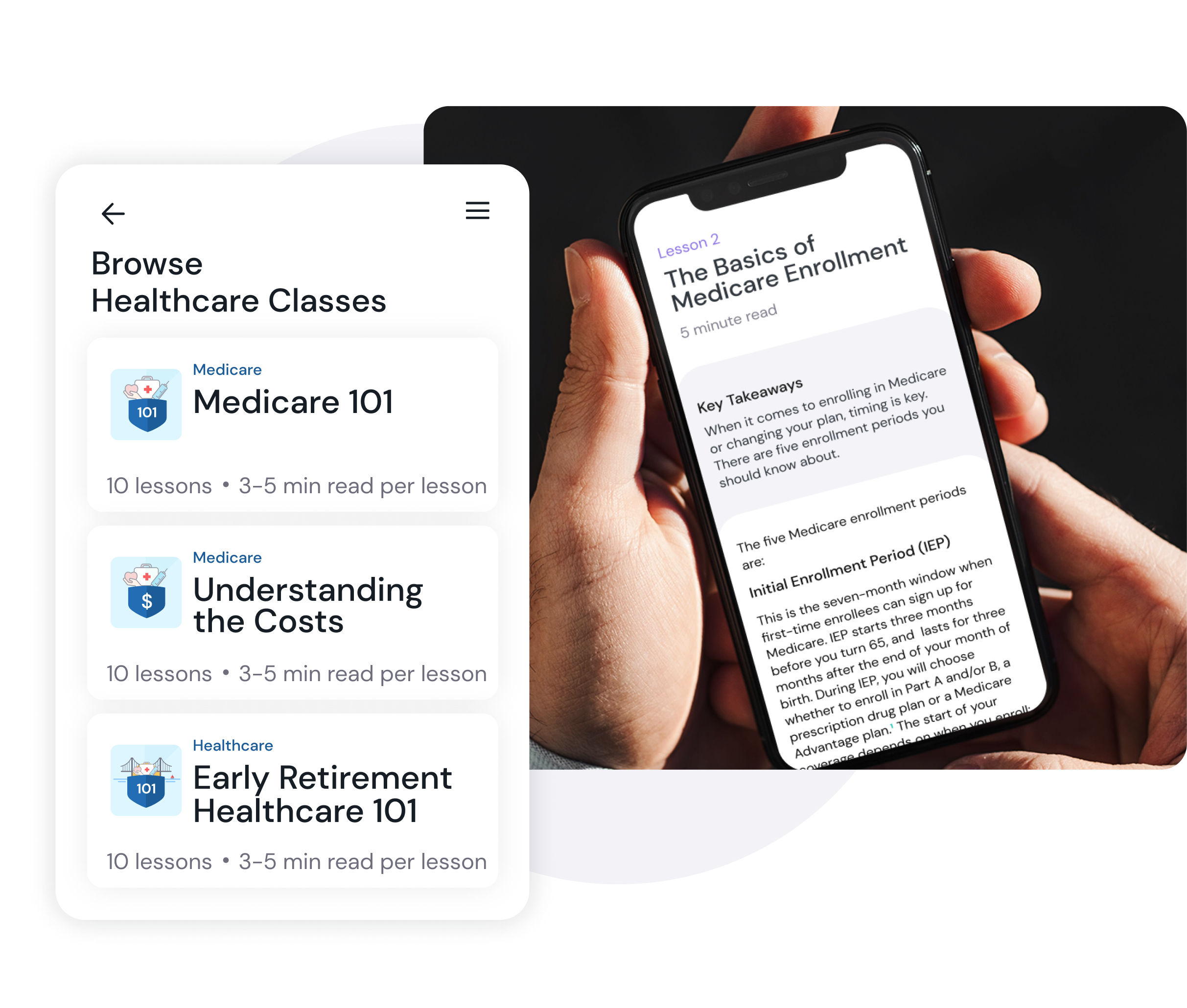

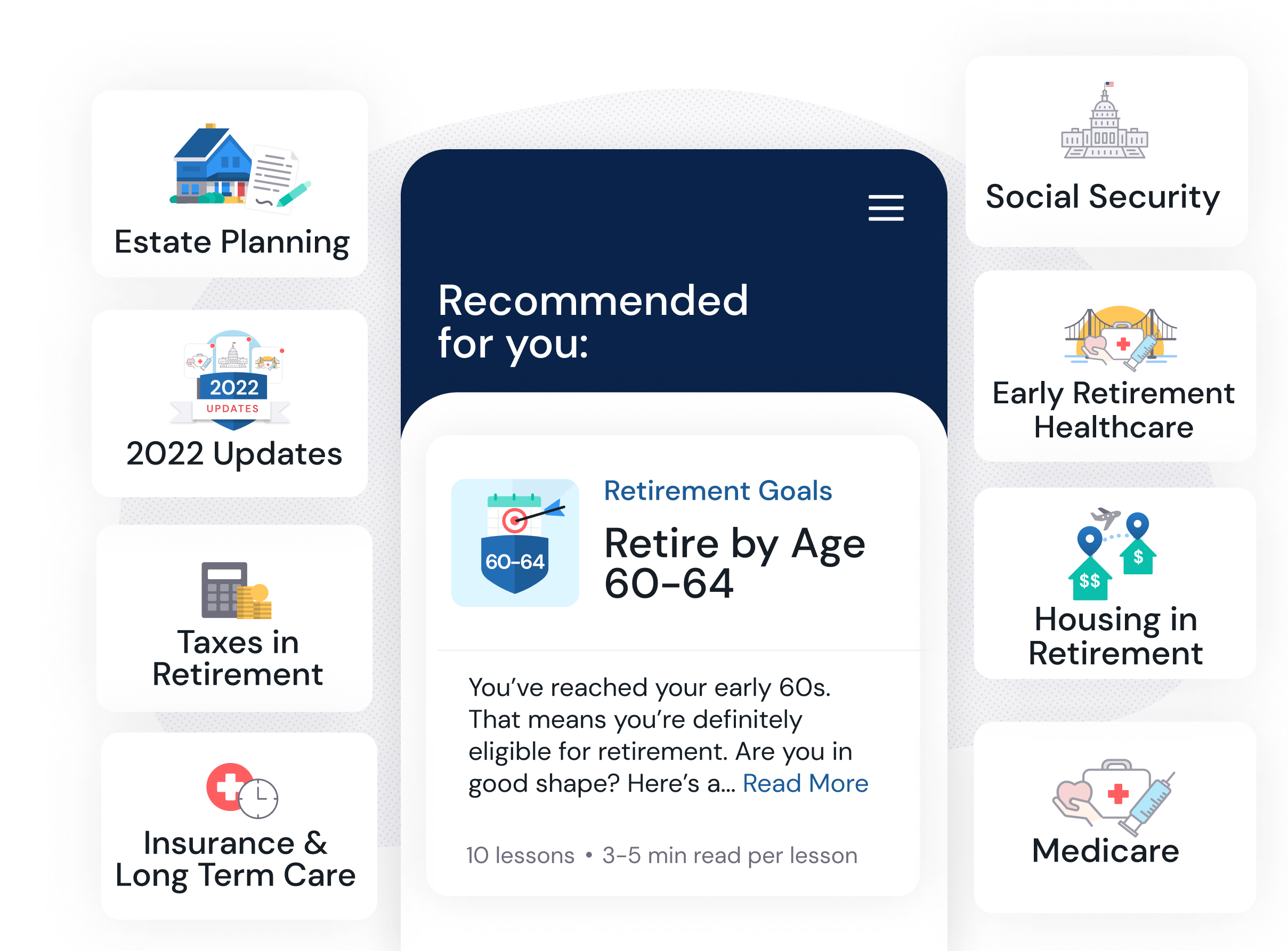

Choose from over 500+ educational lessons to understand Social Security, Medicare, and retirement taxes. Retirement School gets straight to the point with easy-to-read and concise lessons to answer all your questions.

Get answers to all your retirement questions, even the ones you might not have known to ask. From downsizing to retirement taxes, learn how to make your personalized retirement decisions in one place.

About Silvur

Silvur is an award-winning retirement platform that works with credit unions and banks to support Americans aged 50+ navigate modern retirement. Silvur’s patent-pending technology has been featured in top financial publications like Forbes, CNBC, U.S. News and World Report, Kiplinger, Barrons, CNBC, and Yahoo! Finance. Silvur has guided over 120,000 Americans through the use of easy-to-understand guides and data-driven calculators to prepare for retirement.